[ad_1]

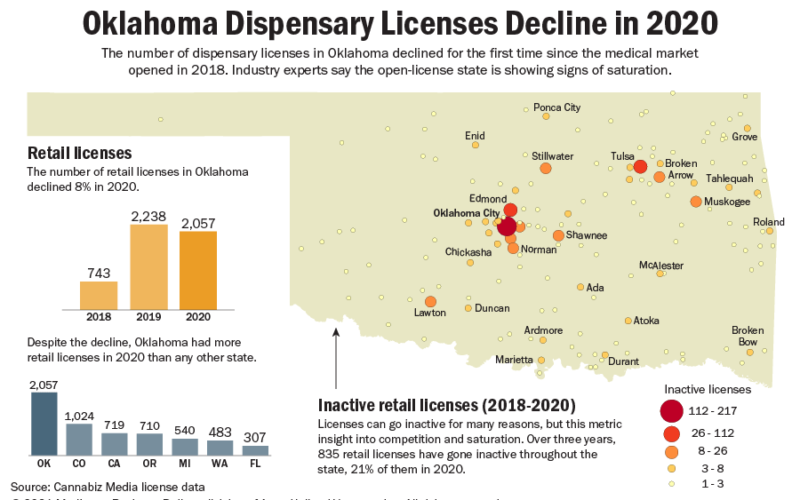

Retail licenses for Oklahoma’s medical cannabis program declined 8% in 2020, the first contraction for the open-license market since MMJ sales began in 2018.

Despite surging sales and patient numbers, Oklahoma ended 2020 with 181 fewer retail licenses than it did in 2019 – even after issuing 565 new permits throughout 2020, according to Cannabiz Media, a Connecticut-based cannabis license database and marketing platform.

Industry insiders say the contraction was expected and is the inevitable result of speculation, increasing competition and market saturation in a state that has no license caps for cultivators, processors and dispensaries.

“There are more licensed dispensaries in Oklahoma than Walmart, McDonald’s and Starbucks combined,” Oklahoma Cannabis Industry Association Executive Director Bud Scott wrote in an email to Marijuana Business Daily.

“To say there is retail saturation is an understatement.”

Despite the 2020 decline, the state led the nation in the number of retail licenses, ending the year with 2,057.

The entire U.S. market for dispensary licenses grew 12%, with other large, mature markets such as California, Colorado and Oregon continuing to add retail licenses in 2020, Cannabiz Media reported.

No other state issued more retail licenses than Oklahoma, with Colorado, its closest competitor, ending 2020 at 1,047.

Ed Keating, the chief data officer at Cannabiz Media, said the decline was not a surprise.

“Since watching the Oklahoma licensing juggernaut, we knew that there would be a rightsizing at some point,” Keating said.

“The market can only sustain so many businesses.”

Keating believes the contraction will continue as the state begins to roll out a seed-to-sale compliance program in April.

“This new compliance burden may make these licenses less attractive if they are not a thriving business,” Keating said.

Scott of the Oklahoma Cannabis Industry Association blames some of the decline on initial license buyers speculating the market would limit permits or make the process more difficult.

That never happened, so many opted not to renew.

Although Scott said he doesn’t have a complete picture of dispensary ownership, he believes franchise operators and new out-of-state brand partners will become more dominant as the market matures, making it harder for independent, single-location owners to compete.

The evolution was predictable, he said, and mirrors the development of other markets in the state such as liquor stores, groceries and pharmacies.

Denise Mink, who owns Med Pharm in Broken Arrow with her husband, Christopher, has seen the saturation firsthand.

Denise Mink doesn’t believe the Tulsa metro area, including Broken Arrow, is as saturated with retail outlets as Oklahoma City.

Still, Med Pharm has several rival dispensaries within a mile or two of its location, and Mink has seen some of them close since 2019.

“A dispensary will close,” she said, “and within a month, a new one will pop up in the same location.”

But the low cost of entry can be deceiving. The license fees are doable for most people, but the cost of getting started will often overwhelm new owners.

“You have to fill that store with product, pay rent or mortgage, hire employees. Add the tremendous competition, and it’s a hard business to be in,” Mink said.

Tracking inactive licenses can give an insight into competition and saturation, even if those permits are let go for other reasons.

Over three years, more than 830 Oklahoma retail licenses have gone inactive throughout the state, 21% of them in 2020, according to Cannabiz Media data.

The largest markets, including Oklahoma City and Tulsa, had the largest number of licenses go inactive, but small markets across the state also experienced declines.

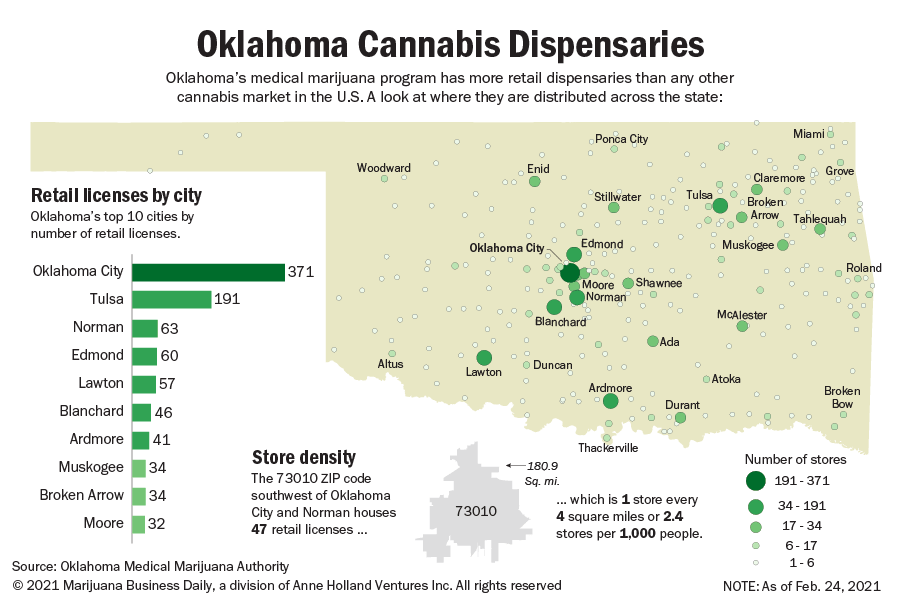

Yet, the fierce competition doesn’t seem to stop the kind of dispensary density seen only in Oklahoma.

Oklahoma City and Tulsa together house more dispensary licenses than Washington state.

Analysis of Oklahoma Medical Marijuana Authority license data by MJBizDaily showed that Oklahoma has 23 ZIP codes containing 20 or more retail licenses each.

The 73010 ZIP code just southwest of Oklahoma City and Norman houses the most, at 47.

That amounts to one license every 4 square miles, or 2.4 licenses per 1,000 people.

But competition doesn’t seem to be hurting sales.

Medical marijuana revenue in Oklahoma more than doubled in 2020, reaching a record of more than $831 million.

Patient numbers also increased to 365,000 in December, up from 220,000 in January 2020.

Oklahoma City cannabis attorney Sarah Lee Gossett Parrish believes businesses can be successful despite the competition.

But to do so, they must differentiate themselves by focusing on helping the consumer.

Attorney Ronald Durbin of Viridian Legal Services in Tulsa also suggests staying focused on efficiencies.

“Our market is growing in leaps and bounds, but the market in any industry will always fluctuate toward the most businesses being the most efficient with the use of resources, price, etc.,” Durbin told MJBizDaily via email.

Andrew Long can be reached at [email protected].

[ad_2]

Source link

Medical Disclaimer:

The information provided in these blog posts is intended for general informational and educational purposes only. It is not a substitute for professional medical advice, diagnosis, or treatment. Always seek the advice of your physician or other qualified healthcare provider with any questions you may have regarding a medical condition. The use of any information provided in these blog posts is solely at your own risk. The authors and the website do not recommend or endorse any specific products, treatments, or procedures mentioned. Reliance on any information in these blog posts is solely at your own discretion.