[ad_1]

(This story has been updated with details of Gov. Ned Lamont’s legislative proposal announced Wednesday.)

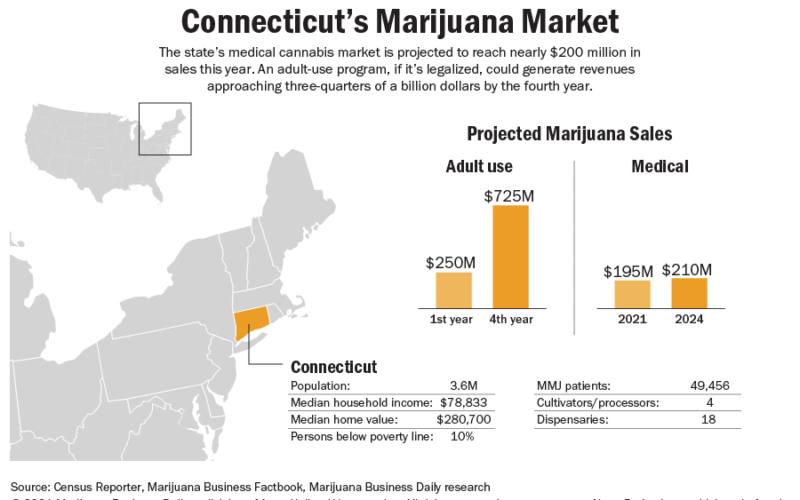

Connecticut’s heavily regulated medical cannabis market is expected to post a respectable 15% increase in sales this year, but it’s the prospect of adult-use legalization and a nearly $750 million market that has multistate operators rubbing their hands.

Several MSOs, including Curaleaf, Green Thumb Industries and Trulieve, have spent tens of millions of dollars in the past two years to enter or expand in Connecticut’s MMJ market and position themselves for the possible legalization of recreational cannabis.

In addition, any adult-use market is expected to generate license and ancillary opportunities for a number of Connecticut-based enterprises, including social equity applicants and small businesses.

Marijuana Policy Project, investment analysts and industry officials all believe Connecticut is likely to be one of the next states to legalize a commercial adult-use market.

They point to pandemic-induced budget woes and pressure from voter-approved, adult-use legalization in nearby New Jersey.

Gov. Ned Lamont, a Democrat, is pushing hard for legalization and, before the coronavirus pandemic, participated in a summit hosted by New York Gov. Andrew Cuomo to develop a regional framework for commercial recreational marijuana.

“I do think it’s tri-state competition and collaboration,” said Michelle Bodian, senior associate attorney in the New York office of Vicente Sederberg, a cannabis law firm.

“At this point, New Jersey is leading the pack. New York and Connecticut are viewing this as an opportunity to catch up.”

But Connecticut House Speaker Matt Ritter, a Democrat, recently put the odds of passing legalization legislation at 50-50.

“I think it’ll be a very, very close vote in the House,” Ritter told the Hartford Courant.

Up to $725 million in annual sales

Marijuana Business Daily projects that an adult-use market in Connecticut could generate $250 million in sales by its first full year and $725 million in annual sales by its fourth year.

By comparison, the state’s medical marijuana market, launched in September 2014, is forecast by the Marijuana Business Factbook to reach $160 million-$195 million in sales this year, up about 15% over 2020.

Sales last year were estimated to be $140 million to $170 million.

Bodian said businesses are interested in the Connecticut market because of its potential opportunities.

Lamont’s legislative proposal, unveiled Wednesday, includes these key aspects:

- Recreational sales would start in May 2022.

- Licenses would be issued by lottery to cultivators, retailers, hybrid medical/adult-use retailers, micro-cultivators, product manufacturers, food and beverage makers, product packagers and delivery services.

- Existing medical marijuana businesses would be able to convert to the adult-use market for a substantial fee.

- Social equity: Delivery service, micro-cultivator, and food and beverage licenses would have lower barriers to entry to help promote equity in the market.

- Each backer may be involved in at most two licenses of each type.

- Municipalities would be permitted to use their zoning code or zoning ordinances to regulate cannabis establishments, except for medical marijuana businesses.

- Three tax types would be imposed: excise taxes on cultivation, a 3% municipal sales tax at retail, and the state sales tax (currently 6.35%) at retail and delivery. The excise taxes would be $1.25 per dry gram of flower, 50 cents per dry gram of trim and 28 cents per gram for wet cannabis.

Keen MSO interest

Many of the players in the Connecticut medical marijuana market are homegrown.

But Massachusetts-based Curaleaf is the biggest player, holding one of four producer licenses and four of 18 dispensary licenses.

Curaleaf began wholesaling medical marijuana in October 2014 and sells to the state’s 18 dispensaries from a 60,000-square-foot facility that opened in the fourth quarter of 2019.

The company and other MSOs also have paid hefty prices to acquire operations in Connecticut in the past couple of years:

- Illinois-based Green Thumb Industries in February 2019 bought cultivator-processor Advanced Grow Labs for $110.1 million, including $15.5 million in cash and 7.3 million subordinate voting shares. The acquisition included a 41,000-square-foot manufacturing facility in West Haven with potential for expansion and a 46% stake in a Westport dispensary called Bluepoint Wellness.

- Curaleaf last year bought the Arrow Cos., which operated dispensaries in Hartford, Milford and Stamford, for $37.7 million, including $16.3 million in cash and the remainder in stock. Curaleaf obtained a fourth dispensary in Groton through its 2020 acquisition of Illinois-based Grassroots Cannabis.

- Florida-based Trulieve acquired The Healing Corner dispensary in Bristol in May 2019 for $19.9 million, according to a regulatory filing. The dispensary, founded in 2014, generated about $12.8 million in revenue in 2019 and serves approximately 10% of the state’s medical marijuana patients, according to regulatory filings.

Medical operators want first crack

Patrik Jonsson, regional president of Curaleaf’s Northeast operations, wrote in an email to MJBizDaily that “as a nascent but high-growth industry, there is significant room for expansion in adult use.”

However, he wrote, it makes the most financial sense to allow medical cannabis operators to fast-track into an adult-use market.

“Using medical operators with a track record of success to jump start Connecticut’s adult-use program is a smart and sound approach that additionally welcomes the success and participation of other businesses,” Jonsson wrote.

“Not only are these providers ready to scale efficiently to build out a legal avenue for purchasing safe and regulated products, they are also prepared to seed critical social equity programs, as has been done in other states.”

Connecticut, like its counterparts New Jersey and New York, has a fairly restrictive MMJ program that could make it difficult to generate enough supply to meet adult-use demand.

The Marijuana Business Factbook characterizes Connecticut’s market as heavily regulated, with the number of available licenses capped at a low number and the market tightly controlled.

“Many dispensaries have been arguing that the four licensed growers won’t be able to meet demand,” according to the 2020 Factbook update.

Jonsson of Curaleaf concurred, noting that “while establishing and expanding an adult-use program is a key priority – the protection and further expansion of Connecticut’s medical program is equally critical.”

It’s unclear, however, whether adult-use legalization will have the necessary support to pass this year – as House Speaker Ritter said.

“But if we do not have the votes – and I’m not raising the white flag – I want to be very clear: We will put something on the board to put to the voters of the state of Connecticut to amend the state constitution to legalize marijuana,” he said.

Jeff Smith can be reached at [email protected]

[ad_2]

Source link

Medical Disclaimer:

The information provided in these blog posts is intended for general informational and educational purposes only. It is not a substitute for professional medical advice, diagnosis, or treatment. Always seek the advice of your physician or other qualified healthcare provider with any questions you may have regarding a medical condition. The use of any information provided in these blog posts is solely at your own risk. The authors and the website do not recommend or endorse any specific products, treatments, or procedures mentioned. Reliance on any information in these blog posts is solely at your own discretion.