[ad_1]

Sales of cannabis pre-rolls surged nearly 50% last year in key recreational markets, defying expectations that the often-shared product would suffer during a global pandemic caused by a respiratory-related virus.

Pre-rolls have become the second-fastest-growing product category as cannabis consumers shop for value products and enjoy the convenience of the prepackaged good.

Pre-roll is the commonly used industry term for a professionally rolled marijuana cigarette, otherwise known as a joint.

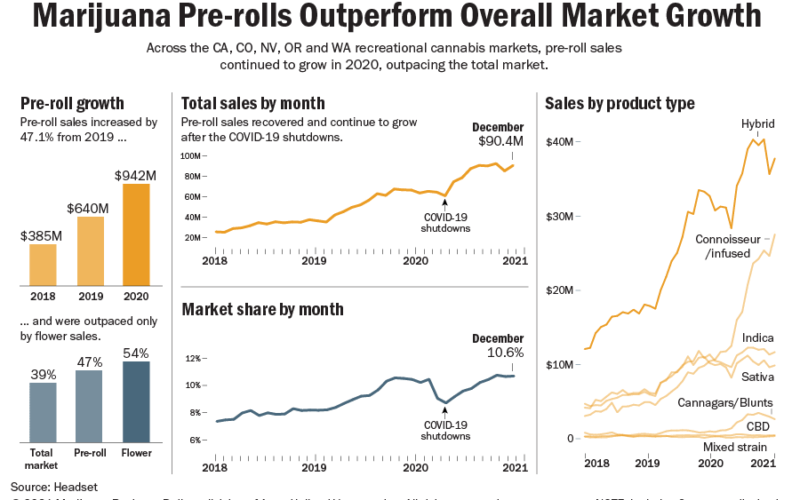

Data from Seattle-based cannabis analytics firm Headset shows that across recreational markets in California, Colorado, Nevada, Oregon (medical and adult use) and Washington state, pre-roll sales increased by 47.1% from $640.1 million in 2019 to $941.6 million in 2020.

This outpaced the total marijuana market, which grew by 39.4% over the same time period. Only flower, which grew by 54%, increased more than pre-rolls.

In 2020, pre-rolls had a 10% category market share by total sales, up from 9.5% in 2019, according to Headset.

Cannabis wholesale marketplace LeafLink, which has offices in Los Angeles and New York, reports that sales of pre-rolls are up on the national level.

Sales of this product category have increased by 144% year-over-year from January 202o to January 2021.

In January 2021, pre-rolls made up 7.94% of total LeafLink market share, an increase of 1.7 percentage points in market share year-over-year.

Why has the product category performed so well? Several explanations are at play, including that pre-rolls are:

- A good way for consumers to experiment with flower strains.

- No longer always sold in 1-gram packages. Half-gram or smaller “mini” pre-rolls are becoming more common and aren’t being shared amid the COVID-19 pandemic.

- Easy to use for new entrants to the market.

- Not just vessels to offload poor-quality shake and trim, as more companies are filling them with high-quality flower.

Strain testing

Narmin Jarrous, chief development officer of Exclusive Brands, a vertically integrated cannabis company based in Ann Arbor, Michigan, said she’s seen a “huge increase in the sale of pre-rolls since last year” to the tune of 45%.

This surprised Jarrous, because she thought of pre-rolls as products to share, which might not be a popular activity during a pandemic.

But new consumers are choosing pre-rolls for their convenience.

“All of those people who don’t know how to roll a joint, this is the perfect product for them,” she said.

Pre-rolls can also be a great way for consumers to try out a new strain and, if it works, come back for a higher quantity such as an eighth or more.

“It’s less commitment,” Jarrous said. “It’s like buying a slice of cake versus buying a whole cake.”

During the pandemic, when people are budget conscious, the product can be a good value.

Exclusive Brands sells pre-rolls for $10-$12 a gram, including some mini-joints.

“People are struggling financially,” Jarrous said, “and they still need access to their medicine, so sometimes the most convenient and acceptable way to do it is a $10 pre-roll.”

Jarrous said the pre-rolls at Exclusive Brands don’t contain shake or trim, and the trend is toward higher-quality flower.

“Cannabis smokers are evolving, and there’s no fooling them,” she added.

Little guys

At Belushi’s Farm in southern Oregon, founder Jim Belushi said pre-rolls make up about 35% of his company’s revenue.

“Since the pandemic, our joint sales have jumped almost 22% since this time last year,” he added.

Despite the significant percentage of the company’s sales, the labor costs to produce and package the joints takes up about 75% of Belushi’s payroll, he said.

According to Belushi, the company rolled a quarter of a million joints in 2020.

Part of the process is automated, but he doesn’t use trim and workers have to grind and separate flower for the pre-rolls.

“Every single joint is carefully handled,” he added.

One of the company’s signature products is a six-pack of quarter-gram joints.

Each pre-roll is small enough that it’s suited for a single person to consume, Belushi said.

The product is selling well enough that the company hopes to expand into a handful more states across the country soon.

‘Parallel sessions’

At Rebelle, a cannabis retailer in Great Barrington, Massachusetts, Chief Commercial Officer Penelope Nam-Stephen said pre-rolls make up about 10% of her sales.

The full-gram pre-roll is the biggest piece of business in the category, which Rebelle sells for around $16.

While that’s a little better value than the smaller pre-rolls, Nam-Stephen said mini-joints are popular among her customers. Two half-gram joints sell for around $20.

“They’re easy for people to have parallel smoking sessions,” Nam-Stephen said. “You can have one and I can have one, and you don’t have to share.”

The retailer also offers pre-rolls using an approach like that of craft brewery flights, where five 1-gram joints of different strains are packaged together for $60.

“It gives people a chance to try a whole bunch of varieties,” Nam-Stephen said, and if a customer likes a particular strain, they can come back and buy it in a larger quantity.

Tourist appeal

Charlie Langston, managing director of vertically integrated cannabis company Wellness Connection of Maine, said sales of the Portland-based company’s pre-rolls have doubled the past two years.

He attributes the success of that category to the products’ ease of use, both for new entrants to the market and people who used to consume cannabis and are getting back into it.

“The pre-roll category is very attractive to newer consumers because it’s a format they’re familiar with,” he said. “It’s just the convenience factor.”

Langston agreed with many of the assessments above:

- Maine consumers enjoy trying out new strains via pre-rolls.

- Mini-joints are gaining popularity.

- Higher-quality flower is more the rule than the exception.

With 40 million sightseer visits a year during normal times to a state known as Vacationland, Langston noted that Maine’s “tourists are not typically traveling with their favorite pipe or whatever.”

Bart Schaneman can be reached at [email protected].

[ad_2]

Source link

Medical Disclaimer:

The information provided in these blog posts is intended for general informational and educational purposes only. It is not a substitute for professional medical advice, diagnosis, or treatment. Always seek the advice of your physician or other qualified healthcare provider with any questions you may have regarding a medical condition. The use of any information provided in these blog posts is solely at your own risk. The authors and the website do not recommend or endorse any specific products, treatments, or procedures mentioned. Reliance on any information in these blog posts is solely at your own discretion.