Sales of marijuana concentrates shot up more than 40% last year and accounted for a larger share of the overall cannabis market, as consumers became more comfortable with the intricate process of dabbing and new technology has made the products easier to use.

In addition, some consumers are moving away from vape products because of respiratory-related health concerns and turning to concentrates such as wax, hash and shatter, according to industry insiders.

Meanwhile, the wholesale price of concentrates – which deliver a stronger dose of THC than other products such as flower – is rising in the face of the increased demand.

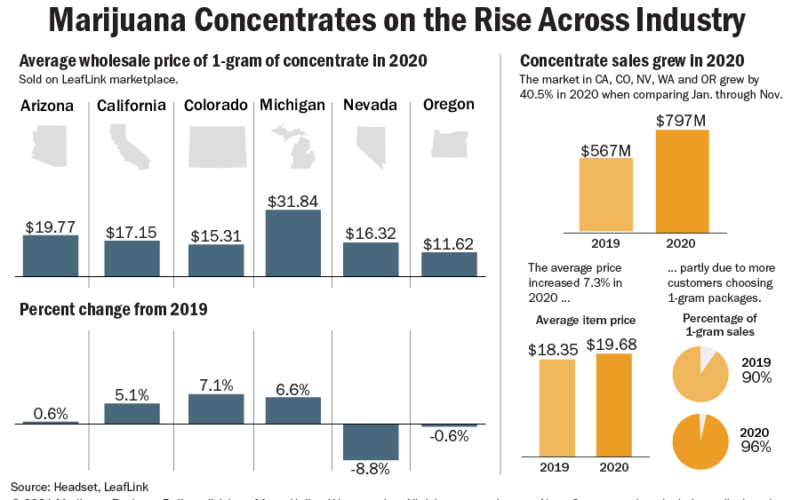

According to Seattle-based data analytics firm Headset, sales of marijuana concentrates surged 40.5% last year in the adult-use states of California, Colorado, Nevada and Washington as well as the recreational and medical markets in Oregon.

The data compares January to November sales in 2020 to the same period in 2019.

Headset defines a concentrate as “a product mechanically or chemically derived from cannabis with a higher cannabinoid potency than the original plant material, usually intended for smoking or vaporizing.”

The company has a separate category for vapor pens, so that sector is not included in these statistics.

Total sales of concentrates increased from $567 million in 2019 to $797 million in 2020, according to Headset.

For the same states listed above, the average item price for a concentrate product at the wholesale level increased by 7.3%, from $18.35 in 2019 to $19.68 in 2020.

Headset said this likely stems, in part, from more customers choosing 1-gram over half-gram package sizes.

For example, in December 2019, 90% of all units sold were 1-gram packages. By December 2020, that proportion of unit volume had increased to 96%.

Cannabis wholesale marketplace LeafLink, which has offices in Los Angeles and New York, tracks concentrates as the following products:

- Badder

- Budder

- Crumble

- Crystalline

- Distillate

- Hash

- Kief

- Live resin

- Moon rocks

- Oil

- Rosin

- Shatter

- Sugar

- Terp sauce

- Wax

(See chart above for LeafLink’s concentrate pricing breakdown by state.)

Facts and Factors, a market research organization in Pune, India, conducted a study that found the global marijuana concentrate market was estimated at $1.8 billion in 2019 and is expected to reach $5.9 billion by 2026.

Sophisticated consumption

As legal marijuana markets mature, so follow the consumption habits of the consumers in those states.

The concentrates category is typically thought of as the next level for the experienced cannabis connoisseur.

That’s because the products are often very potent – with THC content as much as 95% compared with 20%-35% for flower – and traditionally require a complicated smoking apparatus, commonly known as a dab rig, to consume.

“Heavy consumers that are smoking or dabbing every day, they certainly build up a tolerance for stronger stuff over time,” said Mike McDonald, president and CEO of San Francisco Bay Area-based Ammonite, which makes the marijuana hardware Dablicator.

He added that his company has seen a trend toward concentrates in both Colorado and California, two of the more mature legal markets in the United States.

McDonald said cannabis connoisseurs are always looking for better-tasting, purer, more-potent concentrates.

“You’re really seeing an upscale of the market in regards to concentrates,” he added.

Nick Tennant, founder and chief technology officer of Precision Extraction Solutions, a hemp- and marijuana-extraction company based in Detroit, said concentrates are often a small segment of a new market when it first goes online.

“We tend to see an 80%-20% in favor of flower in early markets,” he said. “As consumers become more seasoned, you see that trend shift.”

The shift can go all the way to 65% flower versus 35% concentrates as the market evolves, according to Tennant.

Katie Bajcar, director of marketing at cannabis extraction company Spherex, based in Aurora, Colorado, agreed, saying there’s a natural transition as consumers grow more experienced.

Spherex makes marijuana oil for vape cartridges, dablicators and infused products, and Bajcar said “there’s definitely a correlation between how long the industry has been around and the types of products consumers are looking for.”

Technology solutions

Randy Buchman, CEO of Emerald Growth Partners which oversees Pleasantrees, a cannabis brand based in Harrison Township, Michigan, said the price of concentrates is going up as more consumers seek them out.

One reason, according to Buchman: Ease of use via new portable technology.

The advent of handheld vaporizers that can combust the different concentrate products makes the products more convenient as well as discreet.

McDonald said the smaller, battery-operated vaporizers have helped to drive this trend. A consumer can carry one in a pocket with a 1-gram jar of concentrate, and it’s completely portable.

“These are devices you can throw in your ski jacket,” he added.

Tennant pointed out that as the technology advances and more consumers are able to try concentrates, the sales will correspondingly increase.

“All of these delivery technologies will further catalyze extraction sales,” he added.

Vape alternative

Consumers who don’t want to smoke flower and are leery of vaping after the health scare that began in 2019 are turning to solventless extracts like live rosin and resin.

Those products contain the properties found in whole marijuana plants beyond THC, including a range of terpenes and minor cannabinoids. They also don’t commonly contain additives.

“The whole vape scare really had people pause and think about what they’re ingesting in their bodies,” Buchman said.

McDonald agreed that the progression among consumers is toward cleaner marijuana oils and other products.

The challenge with solventless products is they’re difficult to scale up, he added.

Bajcar agreed that there was a lot of fear around vaping, but once illicit-market products were identified as the culprit, consumers started pushing for more cannabis-only products, meaning no additives or cutting agents.

“A lot of that fear is going away,” she added.

Bart Schaneman can be reached at [email protected]

Medical Disclaimer:

The information provided in these blog posts is intended for general informational and educational purposes only. It is not a substitute for professional medical advice, diagnosis, or treatment. Always seek the advice of your physician or other qualified healthcare provider with any questions you may have regarding a medical condition. The use of any information provided in these blog posts is solely at your own risk. The authors and the website do not recommend or endorse any specific products, treatments, or procedures mentioned. Reliance on any information in these blog posts is solely at your own discretion.